what happens if my bank returned my tax refund

Also contact the IRS to give them your new address. Eventually they will issue a.

Where S My Refund Congratulations To Everyone That Got Approved Last Saturday Morning For A 3 18 2020 Direct Deposit Please Share The Date You Filed And Your Progress Below Facebook

The general protocol followed by the IRS is that the amount refundable to an individual is directly deposited into the linked bank account.

. TOP 5 Tips If its rejected because the account information doesnt match the name on the check itll bounce back to. The ATO compares that information with your tax return. What happens if my bank account is closed before my tax refund direct deposit is made.

When that bank refuses the direct deposit where it goes back to depends on where it was from. If an electronic refund goes. If you dont get a check two weeks after the bank has returned the money fill out Form 3911 the Taxpayer.

What Happens If My Bank Returned My Tax Refund. Ad Learn How to Track Your Federal Tax Refund and Find The Status of Your Paper Check. Payments you authorize from the account.

Answer 1 of 4. You can file your return and receive your refund without applying for a Refund Transfer. Expect a paper check from the IRS in the mail after your bank has returned the funds.

However it may so happen that. If you dont the direct deposit will be rejected and be returned to the IRS. Generally if the financial institution recovers the funds and returns them to the IRS the IRS will send a paper refund check to your last known address on file with the IRS.

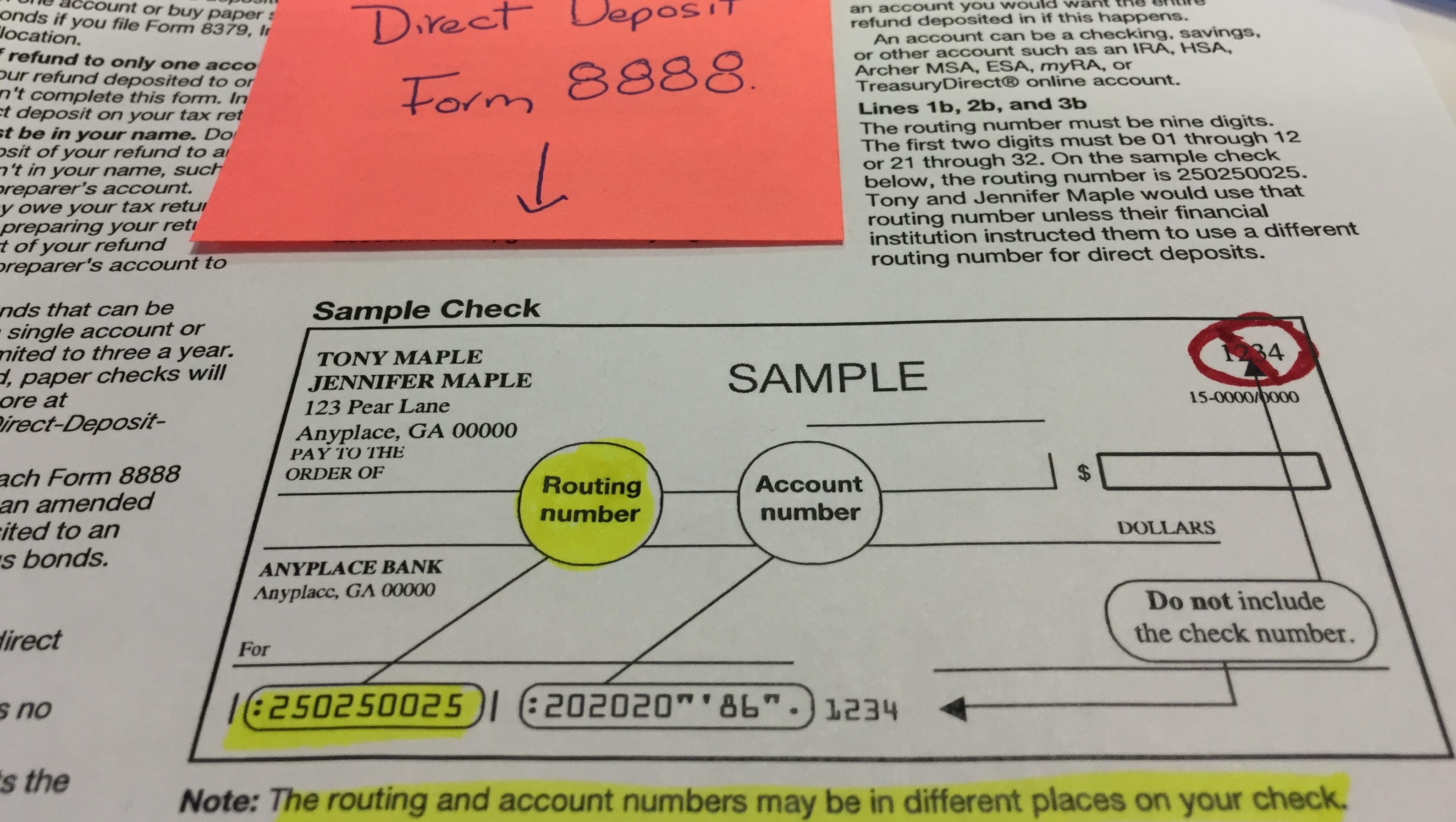

Only electronic refunds are direct deposited into bank accounts hence why they are called electronic refunds. Therefore you need to enter ALL of your bank interest into your annual tax return. If the direct deposit was directly from the IRS the bank would send it back to the IRS who would.

If the ATO find a discrepancy they. You need to do whatever you need to in order to keep that account open. For security reasons we cannot modify the routing number account number or the type of.

In the event that your bank decides not to accept the deposit of your tax refund for whatever reason the monies will be sent back to the Bureau of the Fiscal Service. Once the IRS receives. The Irs updated my wheres my refund on the 27th monday saying it was returned and will be mailed by mar 6 and if not recieved by apr 3 to call back.

Refund Transfer is a bank deposit product not a loan. On the 6 monday it was. Your refund may be delayed if you chose direct deposit but the ownership of the bank account doesnt match up with the filing status on the return such as if you have the.

Once the financial institution recovers the funds and returns them to the IRS it can take up to 5 business days for the IRS to receive the funds back. Check For the Latest Updates and Resources Throughout The Tax Season.

Why Your Irs Refund Is Late This Year Forbes Advisor

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Address Cause Of Tax Refund Failure Then Request Reissuance Experts Business Standard News

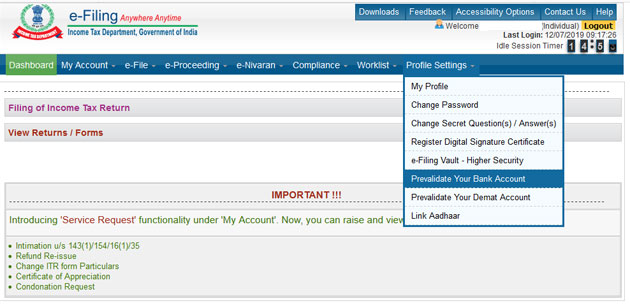

Pre Validate Bank Account In Minutes To Receive Income Tax Refund Here S How Business News

/GettyImages-92125643-b5c3bc0656ab41e48c59795ef5a318bd.jpg)

Tax Refund Missing Reasons You Never Received One

Itr Filing Pre Validate Your Bank Account To Claim Income Tax Refund The Economic Times

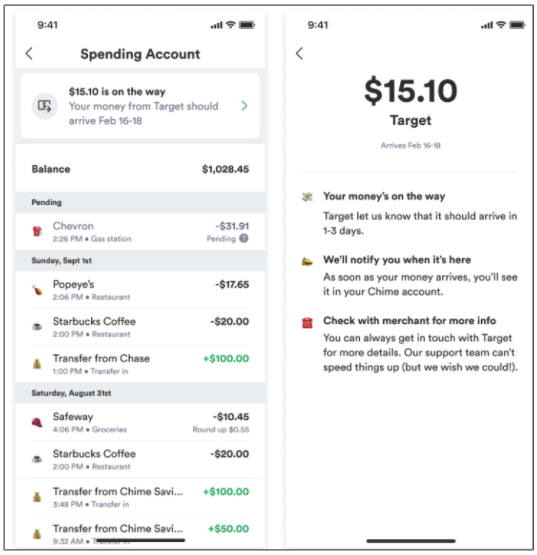

When Will I Get My Refund For A Purchase I Made Help

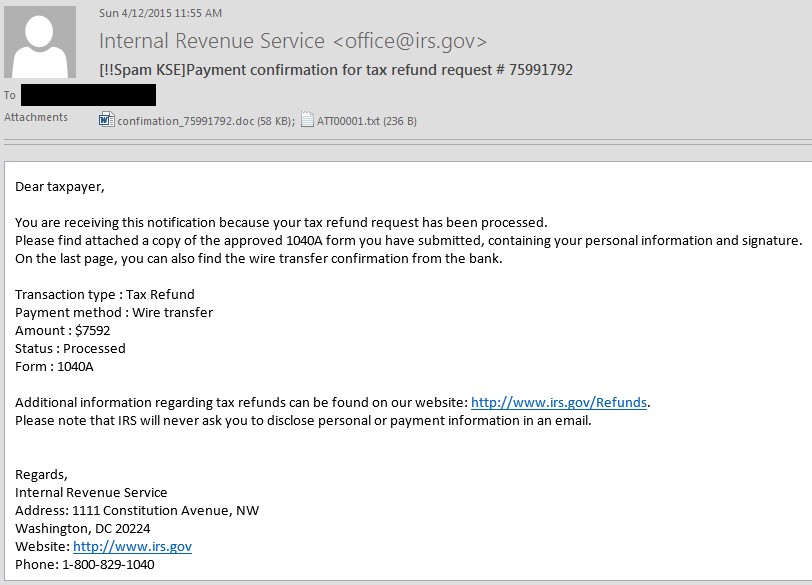

Scam Of The Week Irs Refund Ransomware

Where S My State Tax Refund Updated For 2022 Smartasset

Haven T Received Your Tax Refund Yet Here S What To Do Mint

Direct Deposit For Tax Refunds Can Go Very Wrong

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Tax Refund Schedule 2022 How Long It Takes To Get Your Tax Refund Bankrate

What To Do If The Irs Lost Your Tax Return Updated 2022

When Will I Receive My Tax Refund Will It Be Delayed Forbes Advisor

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

Solved Can I Force The Bank Routing And Bank Account Number To Print On The 1040 When No Tax Is Owed And No Refund Is Due To Taxpayer Intuit Accountants Community